Table of Content

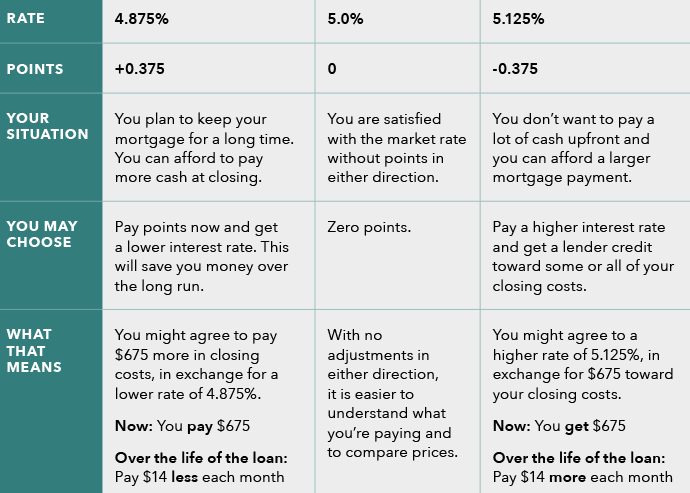

The average closing costs in the United States, if you include taxes, are $6,905, up from $5,749 in 2020. The average closing costs in the United States total $6,905, including taxes. It actually refers to the extra fees you might pay to “buy down” your rate. Discount points add to your closing costs but reduce your interest rate. Closing cost assistance is available from state housing finance agencies and some local governments, lenders, and nonprofits. This typically comes in the form of down payment assistance, which can be used to help pay for your down payment and/or closing costs.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Save $20

If it’s a refinance from a different type of loan into a VA loan, the funding fee is 2.3% if it’s your first use and 3.6% for a subsequent use. Your underwriting fee goes to your lender in exchange for verifying your loan paperwork. You may pay more if you’re buying a very large property or one with unusual boundary lines. In some states, you must get a land survey before you can complete a home sale.

Find out how real estate closing costs are calculated as a buyer and a seller. Ask if your real estate agent is willing to take a lower commission, or work with an agent who offers discounted services. You may receive less marketing than you would otherwise when reducing the agent commission, though. Buying or selling a home is one of the biggest financial decisions an individual will ever make.

Typical Closing Costs for Buyers

VA loan seller concessions follow a couple of different rules depending on what they’re being applied to. Up to 4% of the purchase price or appraised value can go toward escrow accounts and any required VA funding fee. Closing costs don’t include your down payment, but can be negotiated.

Your application fee is nonrefundable, even if you’re rejected for a loan. This fee is paid to the title company or escrow company that is conducting the closing. Their role is to oversee the transaction as a neutral third party.

Estimate your closing costs

Relationship-based ads and online behavioral advertising help us do that. When working with the calculator, please remember the dollar amounts displayed aren’t guaranteed, and what you actually pay may be different. The estimates you receive are for illustrative and educational purposes only.

But if you have the time and energy, here are some proven ways to save closing fees. If you belong to a homeowners association , you may have to pay prorated membership dues when you close on the sale. Lenders generally require you to purchase homeowner insurance before they finance the loan as it protects their investment. Homeowner’s insurance premiums are usually a part of the escrow funds.

The former ensures you end the day with the keys to your new home in hand, while the latter assures your lender that you’re responsible for repaying your mortgage. Agents provide different levels of service and charge different fees. Some sellers prefer to go the FSBO route and cut out the listing agent fee.

A no-closing-cost loan will likely cost you more in the long run due to higher interest. All lenders use standard loan forms called the Loan Estimate and Closing Disclosure. Paying close attention to both of these documents prepares you for the amount of cash you’ll need and when. Depending on the mortgage you take out, there may be some government-backed assistance programs available to you.

You take a higher interest rate for a short time in exchange for very low upfront costs. You’ll have even more bargaining power if you have an excellent credit score and large down payment; in other words, if you’re a ‘prime’ borrower. But for home buyers on a budget — and refinancers getting a significantly lower rate — this strategy can be a smart way to get the loan you need without having to empty your savings. Closing costs are typically 2-5% of your loan amount, with a smaller percentage for larger loans.

Asking the buyer to cover the seller’s closing costs too could make the purchase unaffordable, which is why it’s rare for sellers to attempt to negotiate this concern. Use this seller closing costs calculator to estimate how much you’ll owe in taxes and fees when you sell your home. The default values in the calculator are based on national averages. The fees you’ll actually pay will depend on where you’re selling.

With an FHA loan, there is an upfront mortgage insurance premium, plus a monthly MIP fee for the life of the loan unless you make a down payment of 10% or more. USDA loans have an upfront guarantee fee and an annual guarantee fee that function similarly to PMI/MIP. While this is general advice, Rocket Mortgage® doesn’t offer USDA loans at this time. These are the states with no real estate transfer taxes, which should result in lower closing costs. If you're buying a home and not refinancing, the seller might be willing to cover part or all of your closing costs. If the seller pays them, it's called a "seller concession" or a "seller credit," and you might have to pay more for the house to make up for it.

One point is equal to 1% of the loan; and typically reduces your rate by 0.25%. Not all buyers choose to buy down their interest rate, but if you do, you’ll pay for it at closing. Some lenders, especially for government-backed loans, require you to have an inspection to ensure the home you’re buying doesn’t have any lead paint. The buyer is responsible for the cost, which can vary between $250 and $450. This does not occur on all loans during underwriting, but sometimes the initial report occurred in the month prior to closing, and your lender may require a more recent report.

The average mortgage closing costs, by state

Your lender might ask you to pay any interest that accrues on your loan between closing and the date of your first mortgage payment upfront. The amount of interest you’ll accrue depends on your loan amount and interest rate as well as your closing date. Ou’re required to get a pest inspection before you close on your loan. Pest inspections are also sometimes required if you’re buying a home with a VA loan. It may be required for other loans as well if the appraiser thinks there is a problem. Homeowners insurance is a type of protection that compensates you if your home gets damaged.

No comments:

Post a Comment