Table of Content

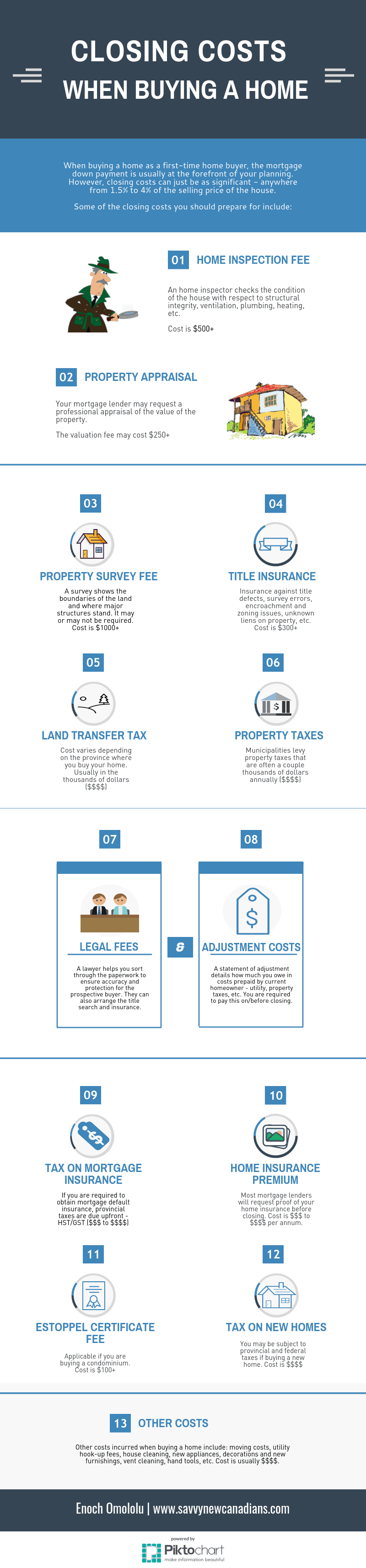

Credit reporting fee is the cost of obtaining a credit report. The lender will use your credit report to estimate your ability to pay back the mortgage. The lender may request your credit report multiple times during the loan application process. The buyer can negotiate certain closing costs with the seller and the lender. What’s valuable about many of these programs is that homebuyers can use them in place of their savings, which is a major financial boon when taking on homeownership. Most experts recommend keeping around six months of expenses in reserves so that you avoid paying for unexpected emergencies with credit cards or personal loans.

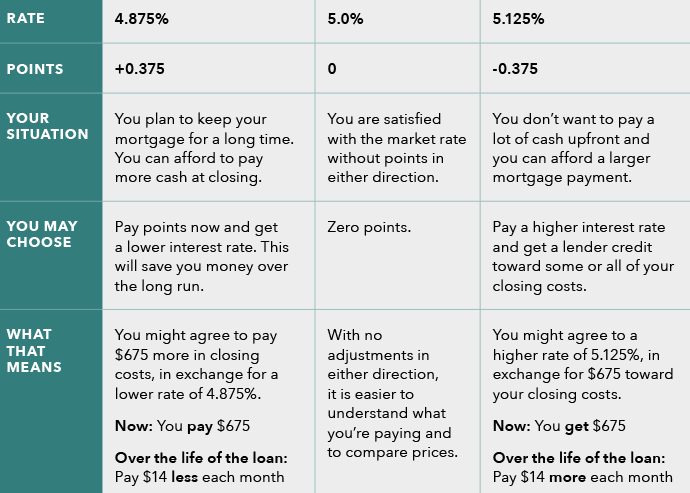

Closing costs are also a drawback for homeowners who want to refinance into a lower rate, but don’t have the cash for upfront fees. There are legal limits to the amount your closing costs can increase on the CD. If you see a change in your fees before closing, be sure to bring it up and get an explanation. If one lender offers a great rate but another offers lower fees, you can bring your low-fee estimate to the first lender and see if it will reduce your costs.

Attorney fee

Your property taxes will be prorated based on your closing date. Some buyers pay their taxes in lump sums annually or biannually. If you don’t pay this way, you might escrow the taxes, which means they would be included as an escrow line item in your monthly mortgage payment to your loan servicer.

After you’re up to date on property taxes, the buyer takes over the dues. Like your property taxes, you’ll need to make sure that you’re paid up with your HOA fees until the date of closing. The HOA fees you’ll owe at closing are usually equal to a percentage of that month’s dues. Contact your HOA to see specifically how much you’ll need to pay before you sell your home. As the seller, you’ll also need to bring a little cash to the closing table to finish out the loan. Let’s take a look at some common closing costs sellers must pay to finalize a home sale.

Courier Fee

The former ensures you end the day with the keys to your new home in hand, while the latter assures your lender that you’re responsible for repaying your mortgage. Agents provide different levels of service and charge different fees. Some sellers prefer to go the FSBO route and cut out the listing agent fee.

Note that closing costs are separate from your down payment, though some lenders may combine them into a single number on your closing documents. Similar to a test for lead paint, a pest inspection inspects the home you’re buying for termites or dry rot. This inspection is required on some government loans and by certain states.

What First-time Homebuyers Should Know About Closing Costs

Did you know that your existing homeowners insurance policy may not cover your property when it’s vacant? If your home is going to be vacant for any period of time, it’s important to talk to your agent about adding a rider to cover that period. If instead of loaning someone is gifting you funds for your down payment or closing costs you will have to provide a letter stating the same.

The cost is typically split evenly between the buyer and seller, but this must be negotiated and detailed in the contract. Private real estate attorneys charge by the hour and rates vary based on their level of expertise and services provided. USDA loan closing costs range from 3% to 6% of the total loan amount. This includes a guarantee fee of 1% of the total loan amount.

How much can I make selling my home?

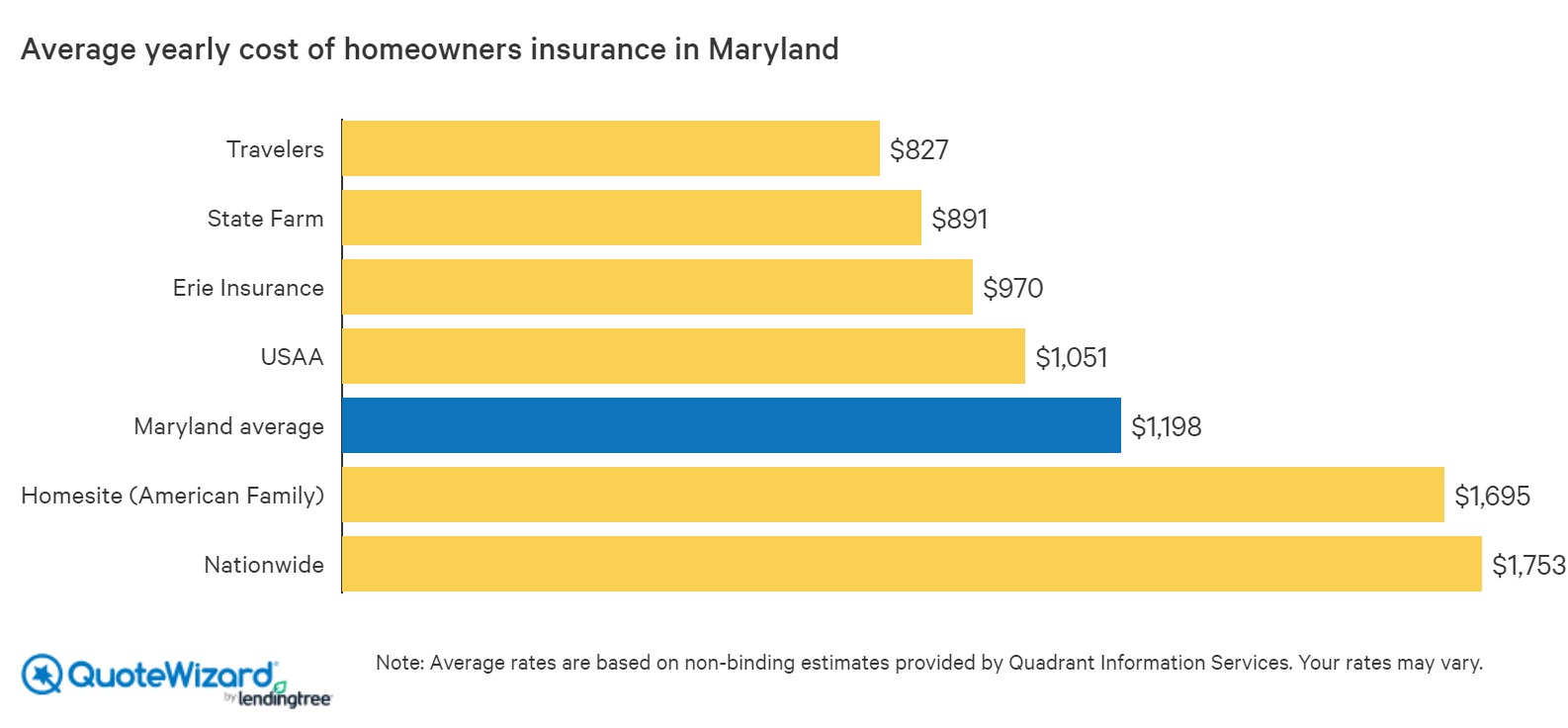

But if you have the time and energy, here are some proven ways to save closing fees. If you belong to a homeowners association , you may have to pay prorated membership dues when you close on the sale. Lenders generally require you to purchase homeowner insurance before they finance the loan as it protects their investment. Homeowner’s insurance premiums are usually a part of the escrow funds.

If you’re just beginning your selling process and are curious about the cash proceeds to invest in your next property, try our home sale proceeds calculator. As mentioned above, some lenders charge origination and/or underwriting fee. You can request the lender to waive these fees or negotiate a lower charge. The VA funding fee is a one-time fee paid to the Department of Veteran Affairs that runs the VA loan program.

Your closing costs could be significantly higher or lower than average depending on the specifics of your home loan. Government-backed mortgages also require an upfront insurance premium or guarantee fee. This covers all or part of the cost for the federal government to insure your loan. Closing costs include just about every upfront fee to purchase or refinance a home, except for the down payment. If you’re using an FHA loan to purchase the home, you’ll be required to pay a premium at closing that totals 1.75% of the base loan amount. You can also roll this into your loan if you’d prefer, but note that you would pay interest on the premium amount.

If you close on Sept. 29, you’ll have to pay for just one day of interest. Generally, your closing costs can end up being anywhere from 2% to 5% of your home’s purchase price. Budgeting for the higher end of those costs should ensure you have enough to close on a home. If the home you are purchasing has a homeowners association, you will pay one month's dues upfront at closing. Homeowners association dues vary by property and cover maintenance fees and operations costs.

This is much easier than having borrowers pay each cost separately. If you find a lender willing to cover part of your closing costs or roll them into your loan amount , you might not even have to pay out of pocket. Your lender will calculate the cost using the daily interest rate, multiplied by the number of days.

You will receive your closing documents three days before the day of closing. Review your closing documents thoroughly to develop an understanding of what you are about to sign. Further, you must ensure that there are no errors in the document, especially basic errors like names, spellings, numbers, etc. Your representative will try their best to ensure that the closing is successful. They will keep your best interests in mind, answer all your questions, and check the documents you are signing. They will also tell you about any special instructions they may have.

If you’re concerned about closing costs, you can try asking your lender to waive or reduce some of the fees. If you purchased points to lower your interest rate, you will pay a one-time fee for them at closing. A discount point can lower your interest rate by 0.25%–0.5% — and, just like interest rates, the price of points changes daily. While it may seem attractive to pay for a lower interest rate, it may not be worth it in the long run if you don't plan to own your home for very long or plan to refinance in the future. Here’s a breakdown of some of the typical closing costs for sellers. To find the net proceeds on your home sale, add the price you paid, the mortgage balance paid, and all the home selling costs.